Since the discovery of large offshore oil and gas reserves in 2014, Senegal has set its hopes on fossil fuel export revenue to help fund its plans to become an emerging economy by 2035. Senegal is actively seeking investors to help develop its offshore oil and gas reserves – both for production and export infrastructure as well as domestic downstream use of fossil gas.

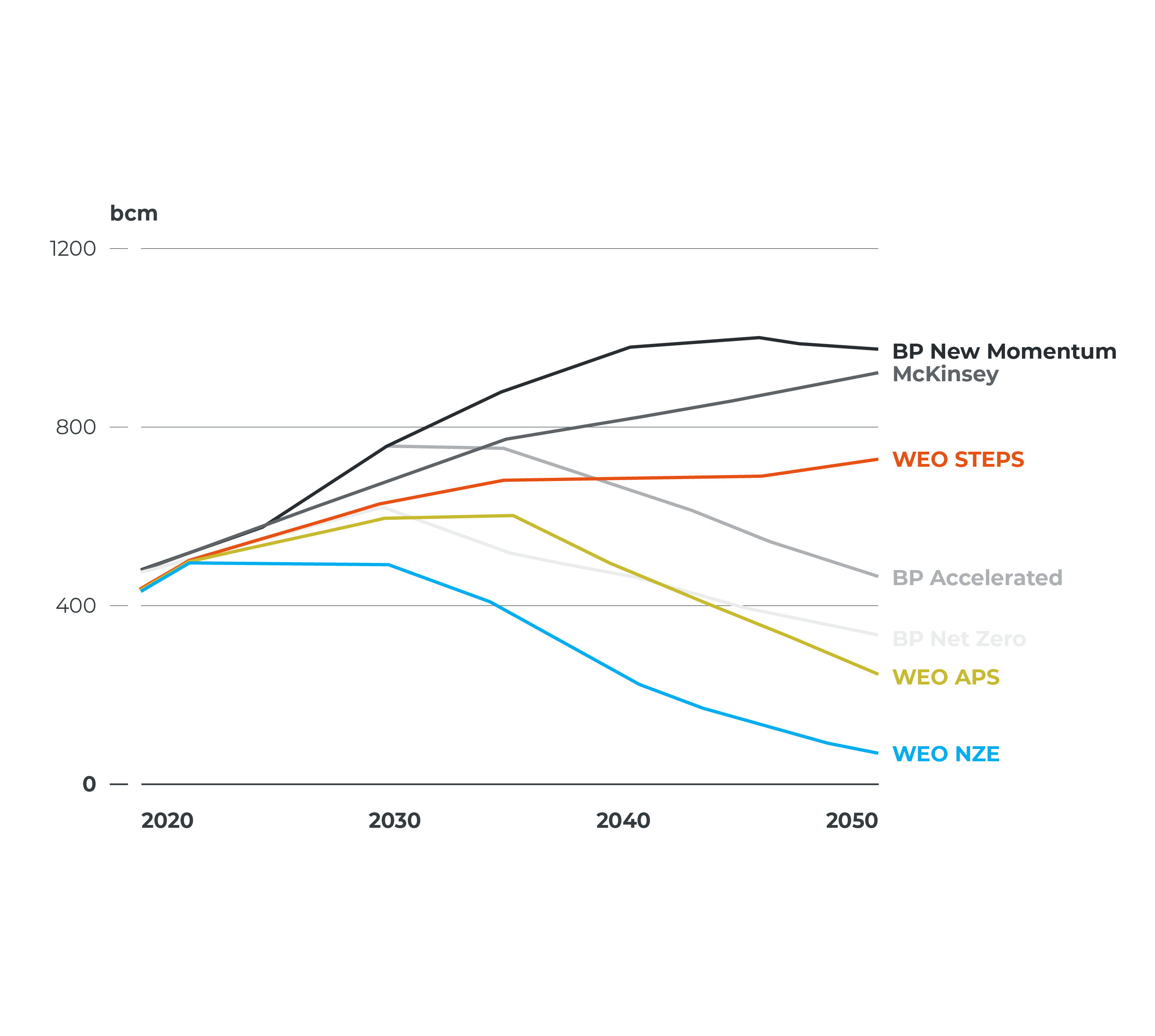

Globally, the role of fossil gas and LNG is rapidly shrinking due to the rapid expansion of renewable energy and a growing recognition of the high climate impact of methane. The global transition to renewable energy is evident: renewables are increasingly the most competitive option for power generation around the world. More and more countries are also recognising that fossil gas and LNG have significant climate impacts, particularly up and midstream. According to the IEA, the “Golden Age of Gas” is over, no new oil and fossil gas reserve development is needed in a net-zero-compatible future, and fossil gas infrastructure investments increasingly runs risks of stranding.

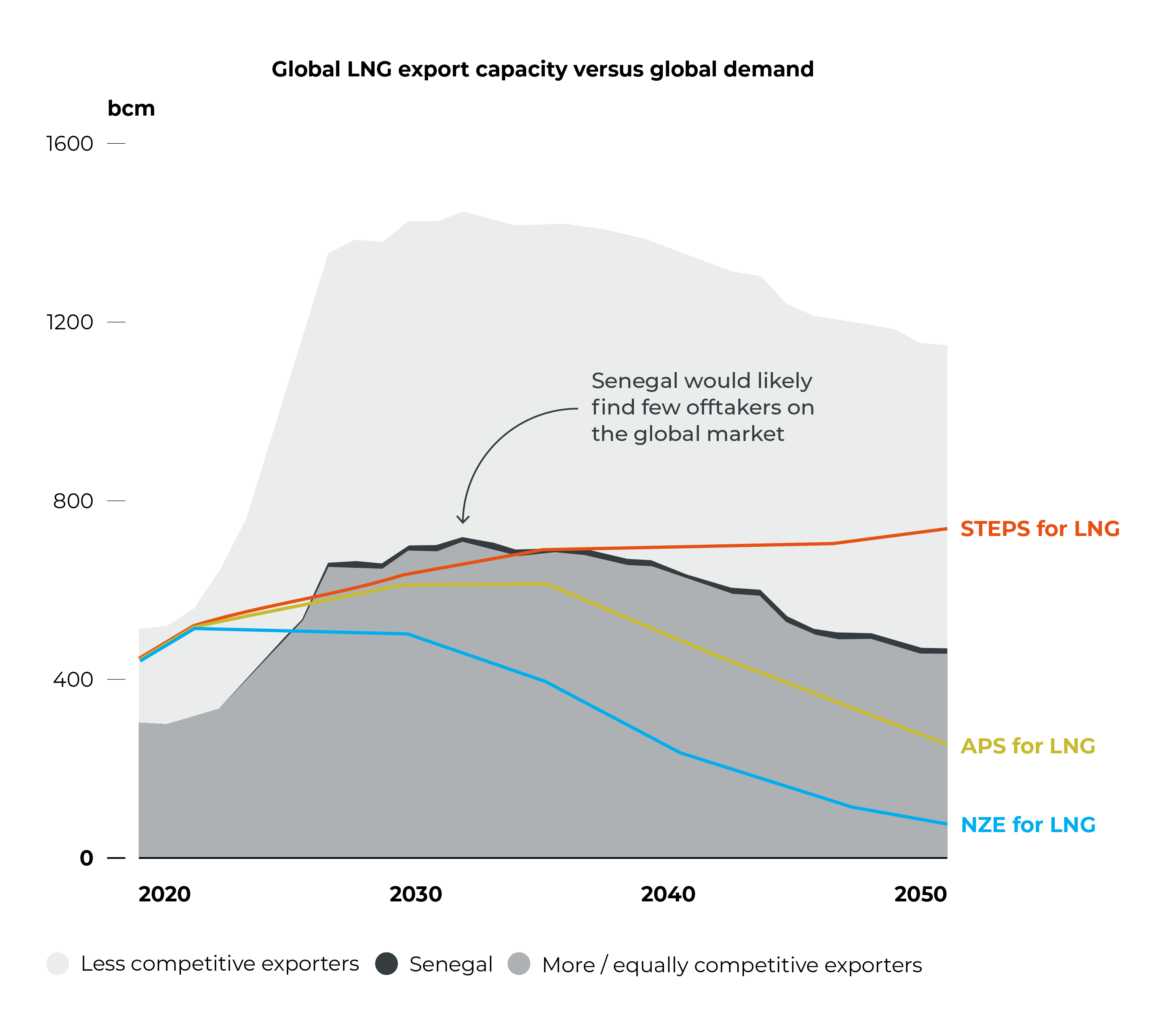

The declining demand for LNG in Europe and around the world casts doubt on the business case for the upfront costs of Senegal’s LNG export infrastructure. Europe's gas demand is rapidly declining as renewable deployment accelerates and end use alternatives are found both for climate and energy security reasons. Gas demand in the Asia Pacific is likely to peak later than in Europe, but the cost competitiveness of incumbent producers and exporters of fossil gas means that the market space for Senegalese LNG exports is likely highly constrained. Senegalese LNG exports are at risk of not being profitable in Paris-aligned scenarios and are also increasingly at risk in current policy scenarios.

Development of the associated extraction and export infrastructure comes at a high cost, not only in up-front investments but also in terms of social and environmental impacts. Of particular significance is the threat that oil and gas development pose to Senegal’s fishing communities which are an important economic driver and play a key role in Senegal’s food security.

Development of the associated extraction and export infrastructure comes at a high cost, not only in up-front investments but also in terms of social and environmental impacts. Of particular significance is the threat that oil and gas development pose to Senegal’s fishing communities which are an important economic driver and play a key role in Senegal’s food security.

Senegal's oil and gas reserve development plans stand at a critical juncture, as they orient energy policy in the opposite direction from the country's Just Energy Transition Partnership (JETP) goals and are at a significant risk of asset stranding. Faced with global declining demand, Senegal may wish to consider its large oil and gas production plans.