For the 2024 iteration of the Corporate Climate Responsibility Monitor, click here.

The Corporate Climate Responsibility Monitor assesses the transparency and integrity of 24 major companies’ climate pledges and strategies. It evaluates four main areas of corporate climate action: tracking and disclosure of emissions, setting emission reduction targets, reducing own emissions, and taking responsibility for unabated emissions through climate contributions or offsetting.

Key Insights

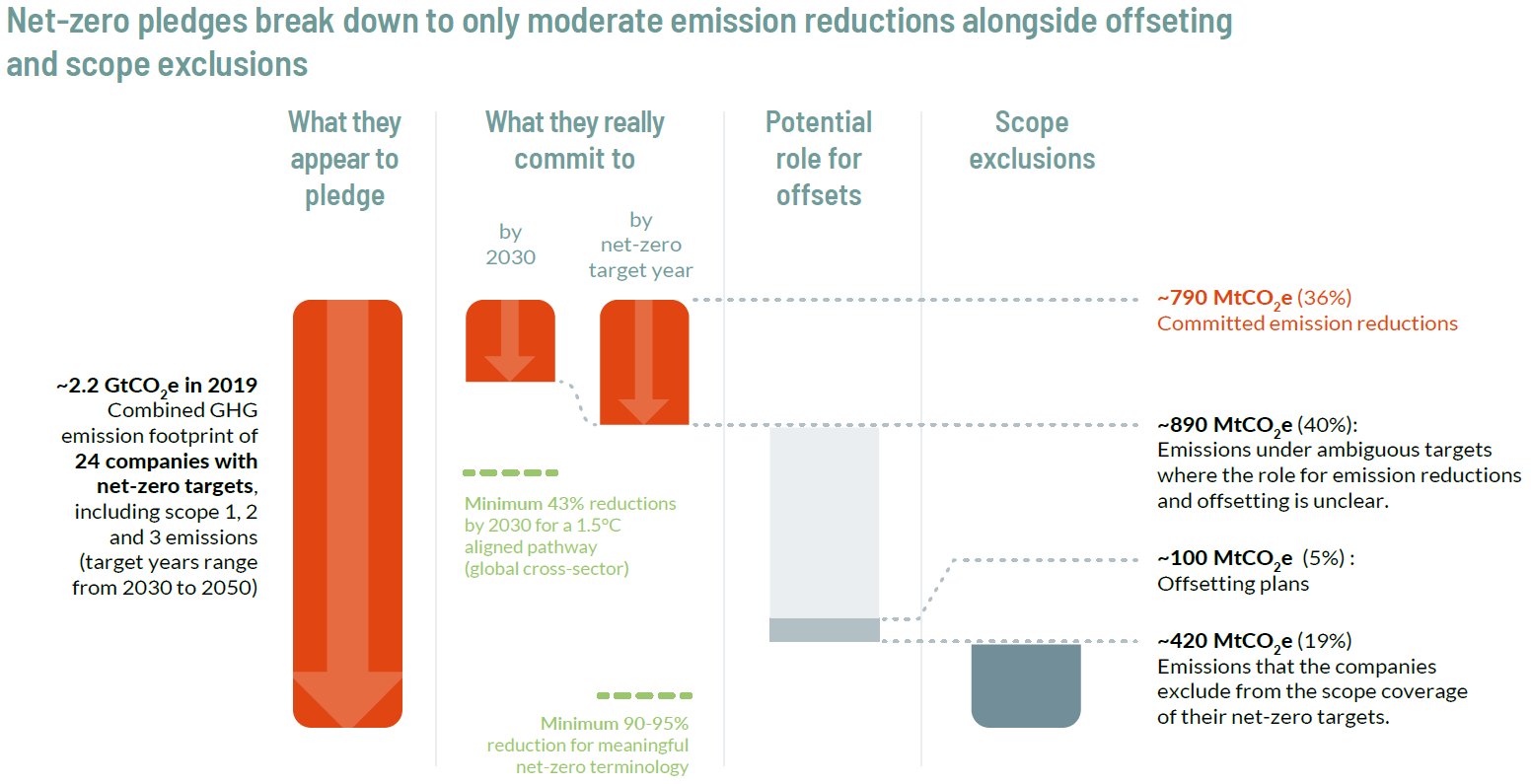

The 24 companies assessed in this report are major multinational companies. Their total self-reported GHG emission footprint in 2019, including upstream and downstream emissions (scope 3) amount to approximately 2.2 GtCO2e. This is equivalent to roughly 4% of global GHG emissions in 2019. Ten of the 24 companies were also assessed in the 2022 Corporate Climate Responsibility Monitor. The repeat analysis of this small sub-set of companies offers insights into what progress has been made over the past year.

Most companies’ climate strategies are mired by ambiguous commitments, offsetting plans that lack credibility and emission scope exclusions, but replicable good practice can be identified from a minority.

The companies analysed in the 2023 Corporate Climate Responsibility Monitor have put themselves forward as climate leaders. The 24 global companies that we have assessed comprise of the largest three global companies from eight major-emitting sectors, including only those that are members of an initiative affiliated with the Race to Zero campaign. Through this, they have committed themselves to preparing and implementing decarbonisation plans that align with the objective to limit warming to 1.5°C. These companies serve as role models for other large, medium, and small companies around the world. The analysis of these companies should provide the best prospects for the identification of replicable good practice. Scrutiny of their plans is also necessary to identify whether these companies set the right examples.

Overall, we find the climate strategies of 15 of the 24 companies to be of low or very low integrity. We found that most of the companies’ strategies do not represent examples of good practice climate leadership. Companies’ climate change commitments often do not add up to what their pledges might suggest.

Figure 1: Integrity of corporate net-zero pledges.

There is a critical need to shift attention to the 2030 blind spot. Companies’ climate pledges for 2030 fall well short of the required ambition and are inappropriately verified.

Companies’ 2030 targets cannot be taken at face value. Nearly all the 24 companies that we assessed have pledged 2030 targets, but we find that these targets can rarely be taken at face value. For many companies, 2030 targets address only a limited scope of emission sources, such as only direct emissions (scope 1) or emissions from procured energy (scope 2) and only selected other indirect emission categories (scope 3). Scope 3 emissions account for over 90% of the GHG emission footprints for most of the companies we have assessed. For others, 2030 targets are misleading due to reliance on offsetting.

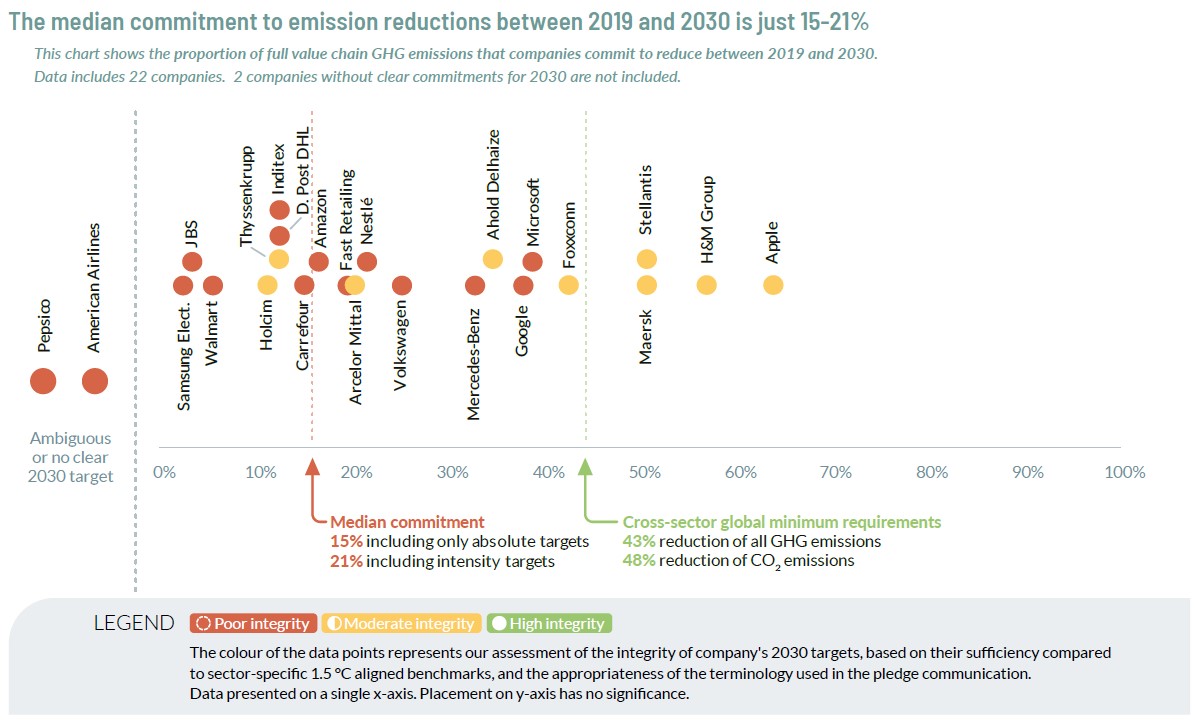

Climate pledges for 2030 fall well short of the economy-wide emission reductions required to stay below the 1.5°C temperature limit. For the 22 companies with targets for 2030, we find that these targets translate to a median absolute emission reduction commitment of just 15% of the full value chain emissions between 2019 and 2030. This may increase to 21% under the most optimistic scenario that emission intensity targets translate to equivalent absolute emission reductions. This compares to the need to cut global GHG and CO2 emissions by 43% and 48% between 2019 and 2030 respectively, to be in line with the goal to limit the global temperature increase to 1.5°C.

Figure 2: The median commitment of emission reductions between 2019 and 2030.

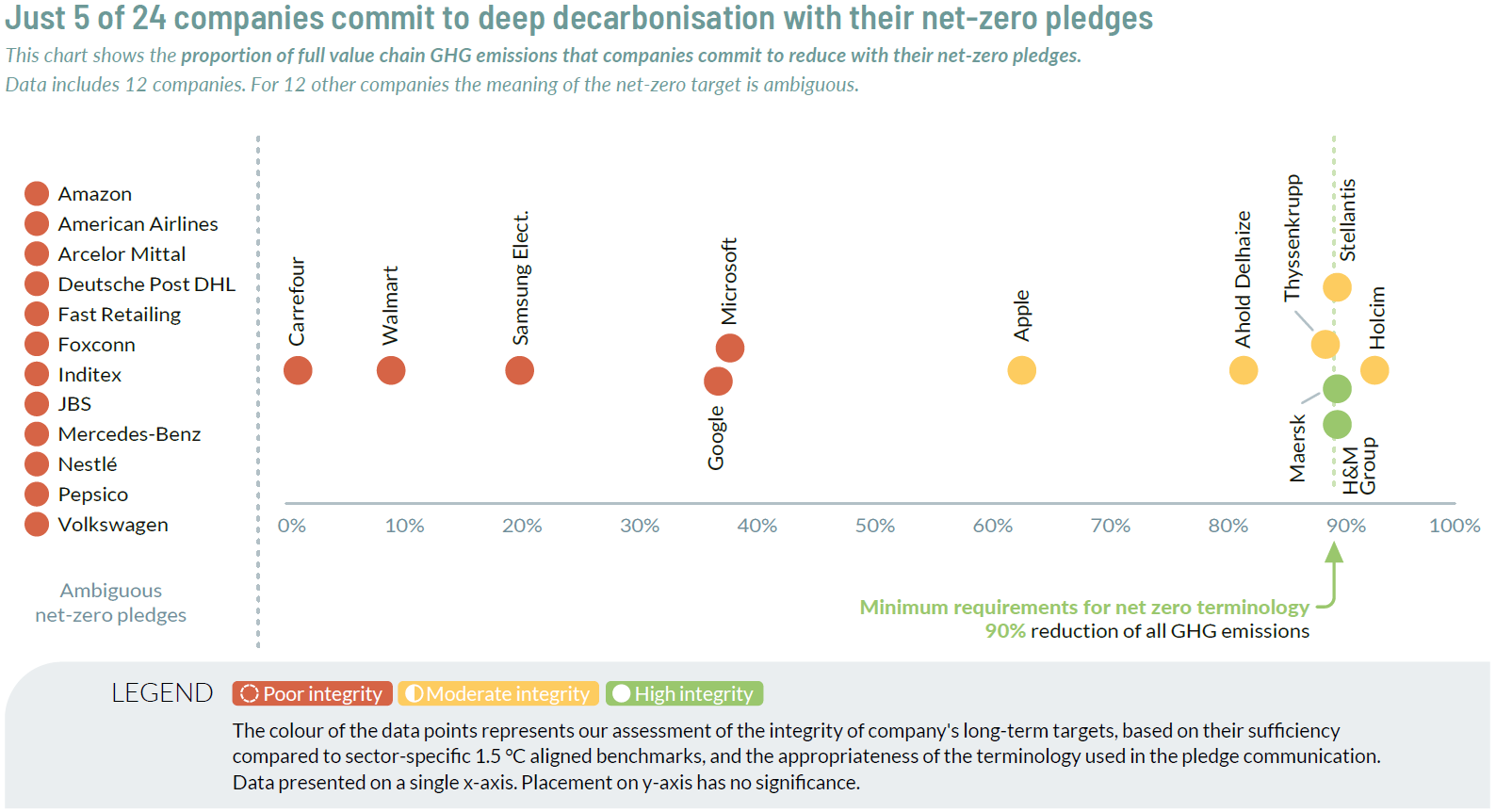

Only a minority of net-zero pledges represent credible commitments to deep decarbonisation, while many remain highly ambiguous.

Only five of 24 companies’ net-zero pledges represent a commitment to deep decarbonisation. All the 24 companies that we assessed have pledged to reach net-zero emissions, carbon neutrality or other pledges of equivalent terminology, but the general quality of those pledges remains poor. Just five out of the 24 companies – H&M Group, Holcim, Stellantis, Maersk, and Thyssenkrupp – commit to decarbonise their emissions by at least around 90% by their respective net-zero target years. We find the long-term targets of 17 companies to be of poor integrity, due to the inadequacy or complete lack of explicit emission reduction commitments alongside ambiguous net-zero pledges. Overall, the net-zero pledges of the 24 companies translate to a commitment to reduce just 36% of the companies’ combined GHG emission footprint, by the respective net-zero target years.

Figure 3: Five companies commit to deep decarbonisation with their net-zero pledges.

Offsetting plans – under various guises – still remain a major stumbling block for the credibility of corporate climate strategies, but the stage is set for a transition to the climate contribution approach.

Developments in 2022 charted a clearer path for a transition from offsetting to a climate contribution claim approach, but companies’ climate strategies appear to be behind the curve of these developments. Misleading offsetting claims are increasingly recognised as a legal liability. The climate contribution approach has traction towards wider implementation through the COP 27 decision to create a ‘mitigation contribution’ unit under Article 6.4, as well as the first-mover announcement from myclimate that it will discontinue its climate neutrality label and transition to a climate contribution model. Companies’ climate strategies are not yet in step with these developments; just four of the 24 companies we assessed reported activities or donations that could be interpreted as climate contributions without a neutralisation claim.