Hydrogen is expected to play an important role in the decarbonisation effort to keep global warming at 1.5 degrees. Net-zero models foresee its share in final energy consumption ranging between 3-20% by 2050. For hydrogen technologies to fulfil this role, sizeable investments need to be made to reduce production costs and improve end-use applications.

The rapid expansion of renewable energy generation capacity is key to clean the global energy matrix, and to ensure that hydrogen future use does not rely on the same fossil fuels expected to be phased out.

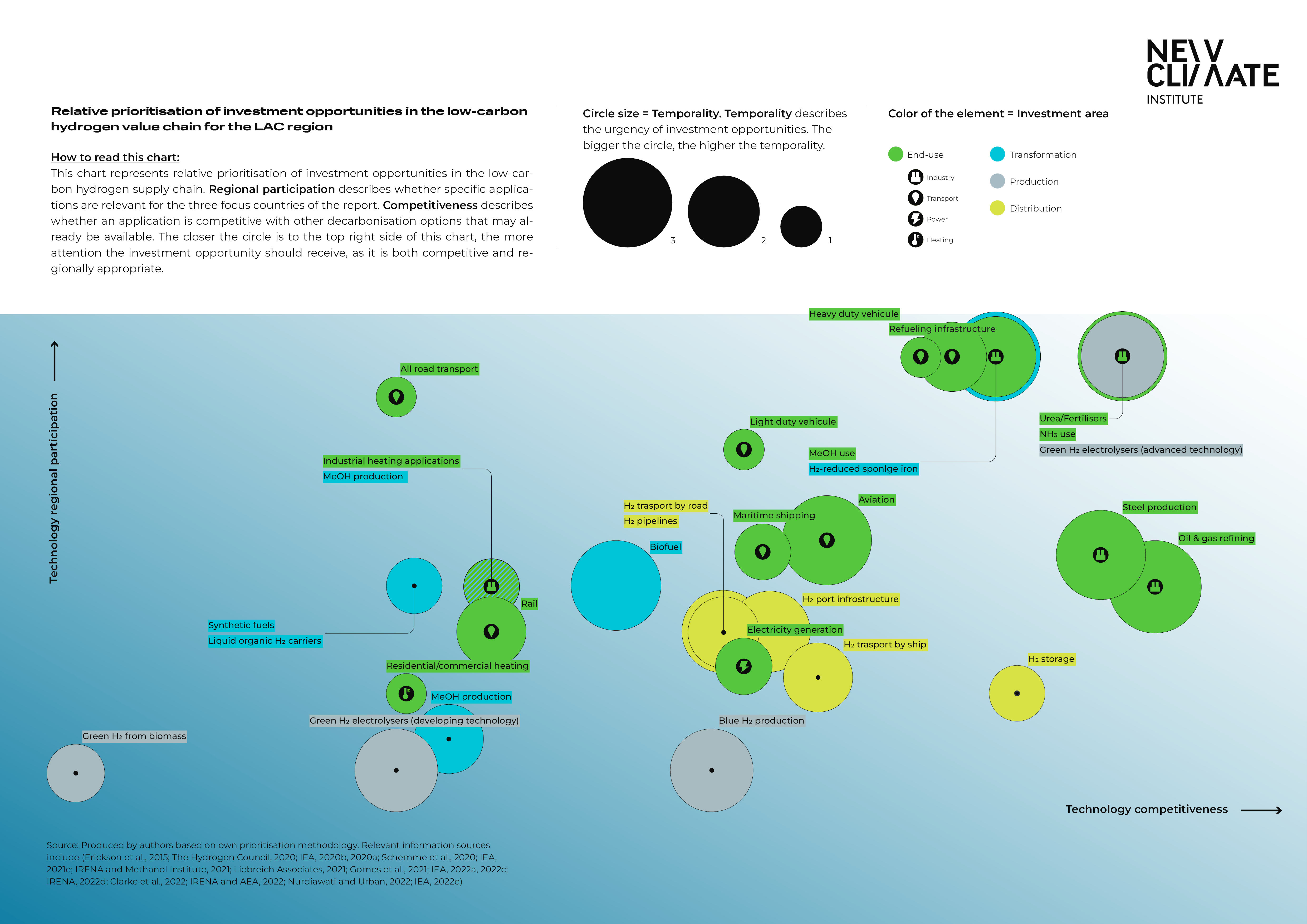

Investment in hydrogen applications needs to be carefully prioritised to focus the limited existing resources in promising technologies that don’t undermine global electrification and other alternative technologies. While most applications are not yet cost-effective compared to current alternatives, investment is needed to reduce production and end-use costs, increase learning and avoid carbon lock-in that can ultimately undermine decarbonisation efforts.

To identify the most promising investment opportunities for the region, and specifically for the focus countries Argentina, Brazil and Peru, this report has analysed different hydrogen applications across the value chain based on three main dimensions: technology competitiveness, temporality of the investment and regional considerations.

Four key investment opportunities were identified for the region:

1. Green steel production

The first hydrogen-based steel plants will soon begin production in Europe, providing technical expertise and examples of potential financing. Early adopters can also benefit from advantages in international trade as consumers increase their demand for low-carbon products. Specific measures like carbon contracts for difference or robust certification schemes could be a starting point to develop green steel markets that mitigate this investment’s risk

2. Green hydrogen production through electrolysis

Electrolyser costs are declining at a fast pace, and substitution of the current hydrogen demand with green hydrogen added to the expected growth of other applications will require even more production capacity than what is currently in the project pipeline. The region has the potential to reach low production costs due to its large renewable energy potential.

The electrolysis project pipeline in Latin America is constantly growing, although a large amount of potential capacity to be added is still in the early stages of planning. Even considering these planned additions, the region needs to more than double the planned capacity additions by 2030 to fulfil the hydrogen production envisioned at that stage in all 1.5-compatible scenarios.

3. Green chemicals - methanol and ammonia, as well as fertilisers

The chemical industry offers another interesting opportunity for the region, as ammonia and methanol are emerging clean fuels, and green ammonia is necessary to produce low-carbon fertilisers. This sector offers a short-term opportunity as hydrogen is already used in the production process, and substitution of fossil-based hydrogen can jump start the low-carbon hydrogen production in the region.

4. Heavy-duty mining vehicles in remote locations

It is the most attractive application in land transport due to the large power and range these vehicles need. To fully avoid potentially volatile fuel purchasing logistic costs, the opportunity lies in developing parallel projects for on-site renewable electricity and hydrogen generation capacity. This application is cost-competitive with a carbon price of around USD 60/tCO2, which make policy interventions key for its successful implementation.

The Latin American region is in an excellent position to become a front-runner and eventually play a key role in a fast-approaching hydrogen economy. To take advantage of this opportunity, however, the right policy signals need to be in place. Clear strategies with a long-term vision for hydrogen and its applications need to be coupled with the right incentives for low-carbon products to attract international finance. A wide range of measures including fiscal incentives, certification schemes and carbon pricing methods are available to countries to accelerate this energy and industrial transition.