Analysing an EU carbon tariff on meat imports with CLIMTRADE

The meat industry is a major, and growing, contributor to global greenhouse gas emissions. Aggregate emissions from animal-based foods are twice those of plant-based products, accounting for in the order of 60% of total food system emissions. Transforming our diets – in particular cutting the consumption of meat in advanced and emerging economies – is a critical challenge we face collectively to avert the most devastating impacts of climate change in the coming decades.

The EU imports around 200 000 tonnes of beef per year from outside of the bloc and outside the direct influence of its own jurisdiction to curb livestock emissions. One initiative, which has gained political traction, is to incentivise emission reductions abroad by imposing carbon tariffs on imported goods – effectively taxing the producers (or sellers) of high-carbon products for the emissions released in their value chain up until the point they arrive at the EU border.

Carbon tariffs can have disruptive impacts on international trade flows, in particular for exporters of emission-intensive commodities. The Economic Impacts of Climate Regulation in Trade (CLIMTRADE) tool helps stakeholders better understand the potential impacts of carbon tariffs and to identify opportunities for securing a competitive advantage in a low carbon global economy. Argentina is one of the largest producers and exporters of livestock commodities. We used the CLIMTRADE tool to highlight the significant transition risks the Argentinian agricultural sector may face as policymakers in export markets begin to crack down on emissions embodied in trade.

The EU CBAM: Carbon tariffs are becoming a reality

Carbon border adjustments have long been touted in theory as a compelling solution to rising consumption emissions, particularly in the US and EU, but often dismissed for their perceived complexity. A lot of data must be collected from third countries to implement them successfully, and until recently, reporting on emissions embedded in products was patchy at best for many countries. However, this is changing. The EU is taking concrete steps to pilot a carbon border adjustment mechanism (CBAM), which is essentially a carbon tariff linked to the EU’s emission trading system (EU ETS). Its objective is to equalise the price of carbon paid by domestic and non-EU producers to avoid undermining European climate policy through what is known as ‘carbon leakage’, i.e. the transfer of emission intensive activities to countries with weaker climate policies.

The EU’s CBAM will initially only apply to emissions-intensive, trade-exposed (EITE) products from heavy industry sectors, such as cement, steel and fertiliser production, as well as electricity generation. Yet growing political voices are calling for an extension of the CBAM to include agricultural imports. As Europe represents the world’s largest import market for agricultural commodities, any eventual introduction of a carbon tariff, or comparable border adjustment, for agricultural products will have disruptive and complex impacts on global markets – especially for developing countries.

EU carbon tariffs on meat imports: Modelling impacts on the Argentinian economy

Argentina is world-renowned for its steak. Its export-oriented livestock sector is the country’s economic backbone. Bovine meat is among the most GHG-intensive and most valuable agricultural outputs in Argentina. Major export markets are Asia (specifically China) and Europe.

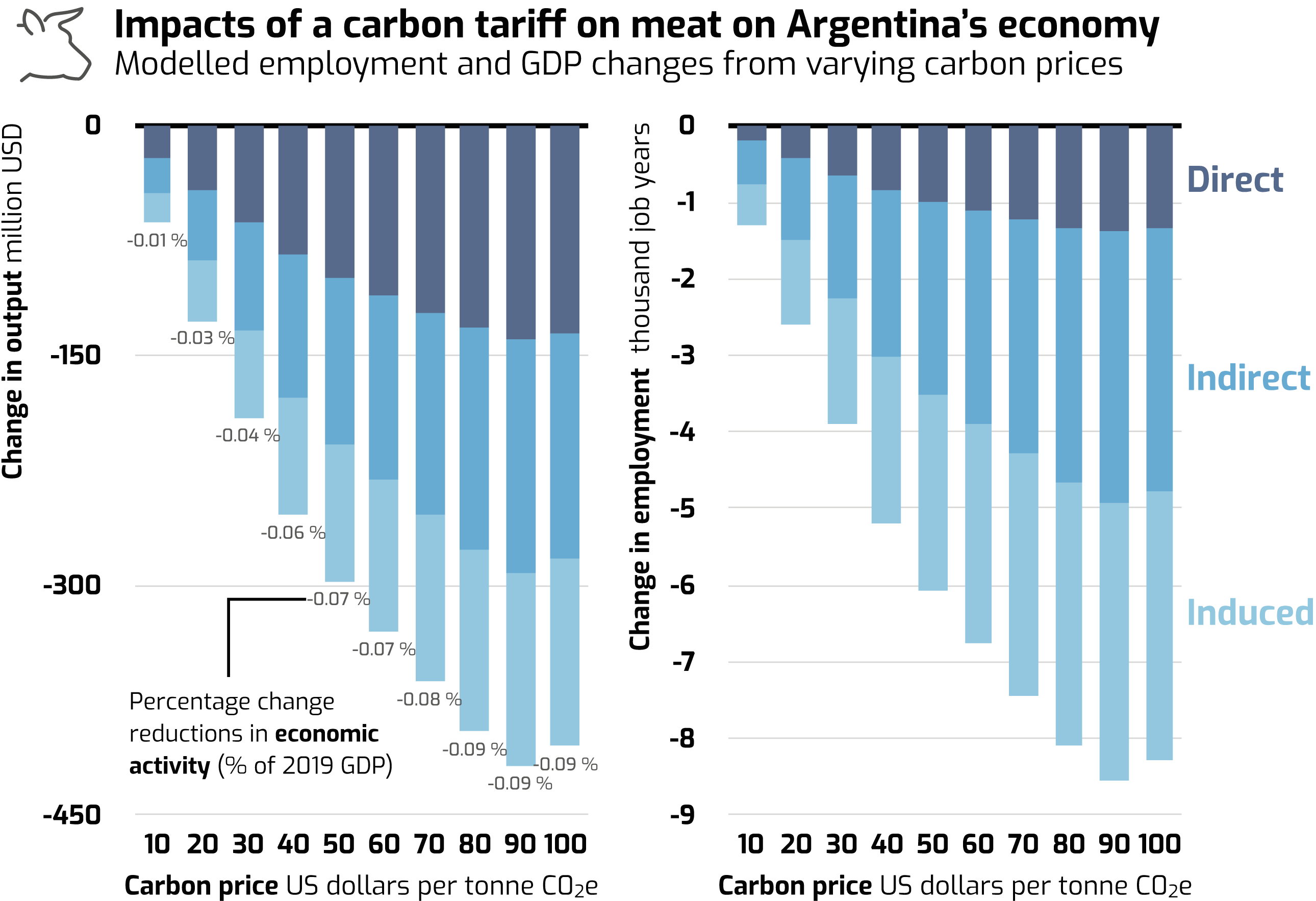

An EU carbon tariff applied to bovine meat imports would likely have adverse economic impacts for Argentina and its livestock sector. Using the CLIMTRADE tool, we estimate a 50 USD/t carbon price (which is markedly lower than the price of emission permits in the EU ETS today, i.e. about 80 USD/t) could reduce Argentina’s annual GDP by around 0.07%, or 0.3 billion USD, with corresponding losses of around 6 000 job years (a full-time equivalent job, lasting one year). The model estimates that the carbon tariff could erode at least 70% of Argentina’s meat exports to the EU. We modelled the impact under carbon prices ranging from 10-100 USD/t. The negative economic impacts for Argentina generally increase with an increasing carbon tariff within this range (see figure below).

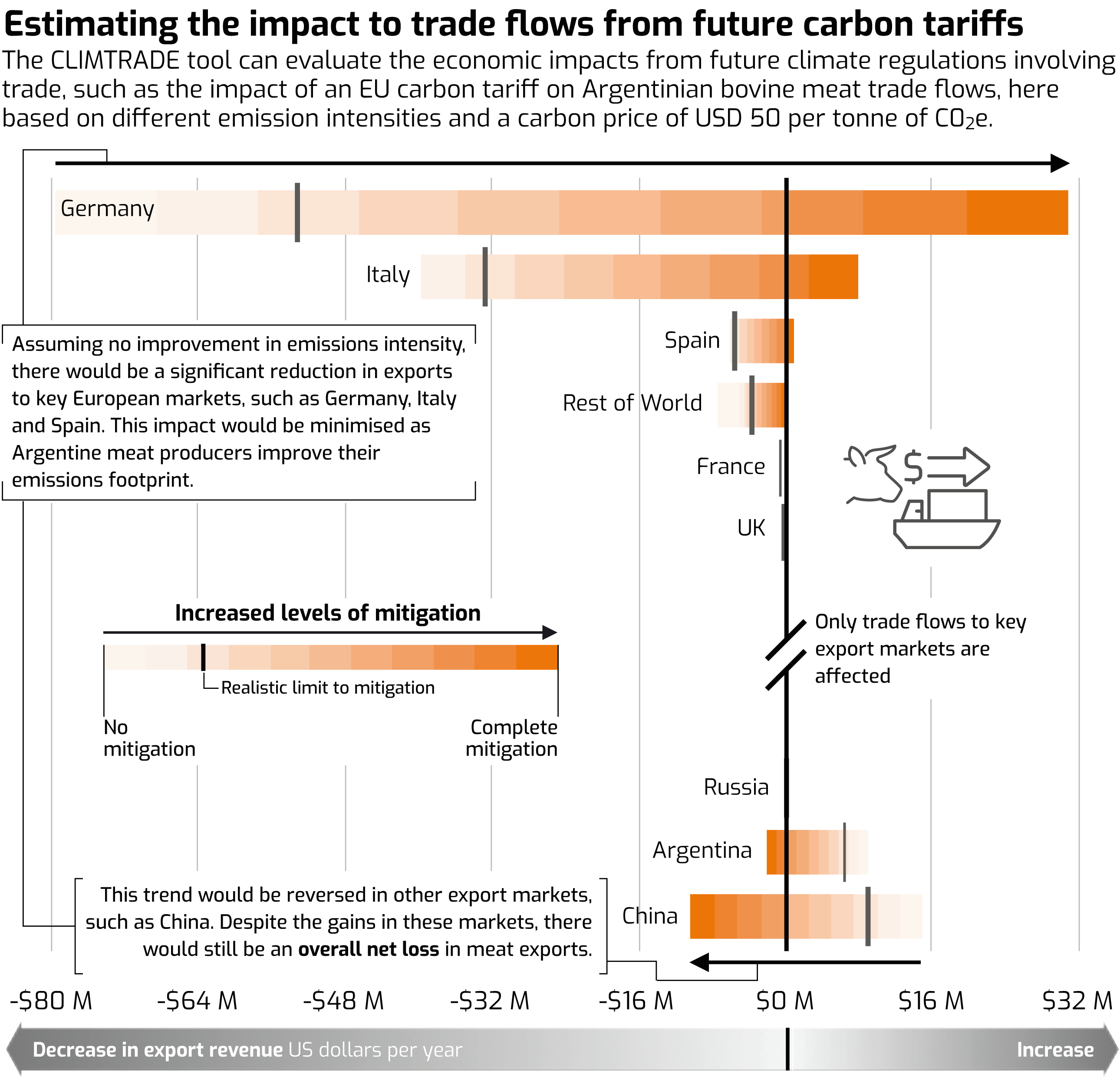

Argentina would incur most of its losses from reduced trade in bovine meat with EU countries, as a result of the EU carbon tariff. However, exports are partly diverted to China, offsetting some of the loss in revenue from EU countries. Lower demand for Argentina’s exports and lower commodity price levels as a result of global oversupply mean that the country is initially not able to fully offset its losses by shifting its trade flows to other export markets (see figure below).

Reducing the carbon intensity of its livestock production systems would offer Argentina an opportunity to lessen the impact of a potential carbon tariff. We estimate that conventional mitigation options in the sector, such as feed optimisation or the implementation of silvopastoral systems, could decrease adverse economic impacts by around 23%. More radical transformations towards a deep decarbonisation in the hard-to-abate livestock sector may not be credible but could in theory further reduce exposure to the carbon tariff and eventually result in economic gains (see figure below).

Decarbonisation of trade flows is imperative, but burdens need to be shared equitably

Trade is driving economic growth and, as such, developing and emerging economies depend on it. Global economic integration leads to stronger international competition and can provide economies of scale as well as technology transfer. For developing countries, commodity trade can be an engine for sustained growth and welfare, but the flow of goods and services across borders also embodies a significant share of global emissions.

Trade per se is not bad; it can also be part of the solution. Environmental trade policy is among the most effective enforcement mechanisms for transboundary climate policy. Policymakers in importing countries can use market-based instruments (tariffs, subsidies, environmental requirements, etc.) to reduce imports of carbon-intensive products and services, and incentivise exporters to decarbonise their production systems.

However, carbon tariffs can be controversial, even if they are aligned with World Trade Organisation rules. There are valid concerns that developing countries carry an excessive share of the burden, although they are least responsible for the bulk of cumulative global emissions to date. This is especially the case for developing countries whose economies are dependent on the export of carbon-intensive commodities. Developed nations need to ramp up their provision of climate finance and support to facilitate transitions in developing countries to ensure that trade policy as a climate action enforcement mechanism is effective.

|

CLIMTRADE: A versatile tool to estimate carbon tariff impacts We developed CLIMTRADE to support the quantitative evaluation of economic impacts associated with the introduction of carbon tariffs. Understanding countries’ exposure to trade-related transition risks is essential for defining informed policy responses. As part of our COMPASS toolbox of open-source models, CLIMTRADE draws on the global simulation model by Francois & Hall (2009), a multi-country global market partial equilibrium representation of industry- or product-level trade flows. CLIMTRADE explicitly models carbon tariffs as a function of a commodity’s emissions intensity and an underlying carbon price. Further, the tool allows users to run mitigation scenario analysis to explore the economic impacts of cutting emissions for certain goods. CLIMTRADE translates trade shocks into domestic economic impacts through Input-Output analysis, reflecting national data that captures the relationships and interdependencies between different sectors. This blog builds on our recently published report series on transition risks and mitigation options in the Argentinian agriculture sector by quantitatively exploring the potential impact of Argentina’s mitigation options in the livestock sector. The tool and analyses were developed under the Ambition to Action project, with funding from the International Climate Initiative (IKI). Calculations in this blog use 2019 data from FAO, UN COMTRADE, and UNCTAD TRAINS. Impact estimates presented here slightly deviate from results published in the report series due to updated emission intensity data. |